Introduction

Climate change has become one of the most pressing issues of our time, and in 2025, its effects are increasingly influencing the global economy. Among the industries most directly affected is insurance. As weather events become more extreme and less predictable, insurers are being forced to reevaluate their risk models, pricing strategies, and policy offerings. This comprehensive guide explores how climate change is reshaping insurance premiums in 2025, providing insights for policyholders, industry stakeholders, and regulators.

Table of Contents

- The Current Climate Landscape in 2025

- How Insurance Premiums Are Calculated

- Key Climate-Related Risks Affecting Insurance

- Sector-Specific Impacts

- Geographic Premium Variations

- Technological Innovations in Climate Risk Assessment

- Regulatory Shifts and Their Impact

- Consumer Impact: Rising Costs and Reduced Coverage

- Case Studies: Countries and Companies

- Strategies for Insurers and Policyholders

- Future Outlook

- Conclusion

1. The Current Climate Landscape in 2025

In 2025, climate change is no longer a looming threat; it is a present reality. Key indicators include:

- A 1.5°C increase in global temperatures since pre-industrial levels

- Increased frequency and severity of wildfires, hurricanes, floods, and droughts

- Coastal erosion and rising sea levels threatening infrastructure

According to data from the IPCC and NOAA, the frequency of Category 4 and 5 hurricanes has doubled over the past decade, directly impacting insured properties and liabilities.

2. How Insurance Premiums Are Calculated

Insurance premiums are determined using several core variables:

- Risk Assessment: Historical data, predictive modeling, geographic analysis

- Claims History: Frequency and severity of past claims

- Replacement Costs: Cost of rebuilding or replacing assets

- Market Competition: Pricing strategies of competing insurers

- Regulatory Requirements

Climate change introduces more uncertainty into each of these variables, challenging traditional actuarial models.

3. Key Climate-Related Risks Affecting Insurance

Property Insurance

- Increased risk of fire, flood, and wind damage

- Rising repair and rebuilding costs

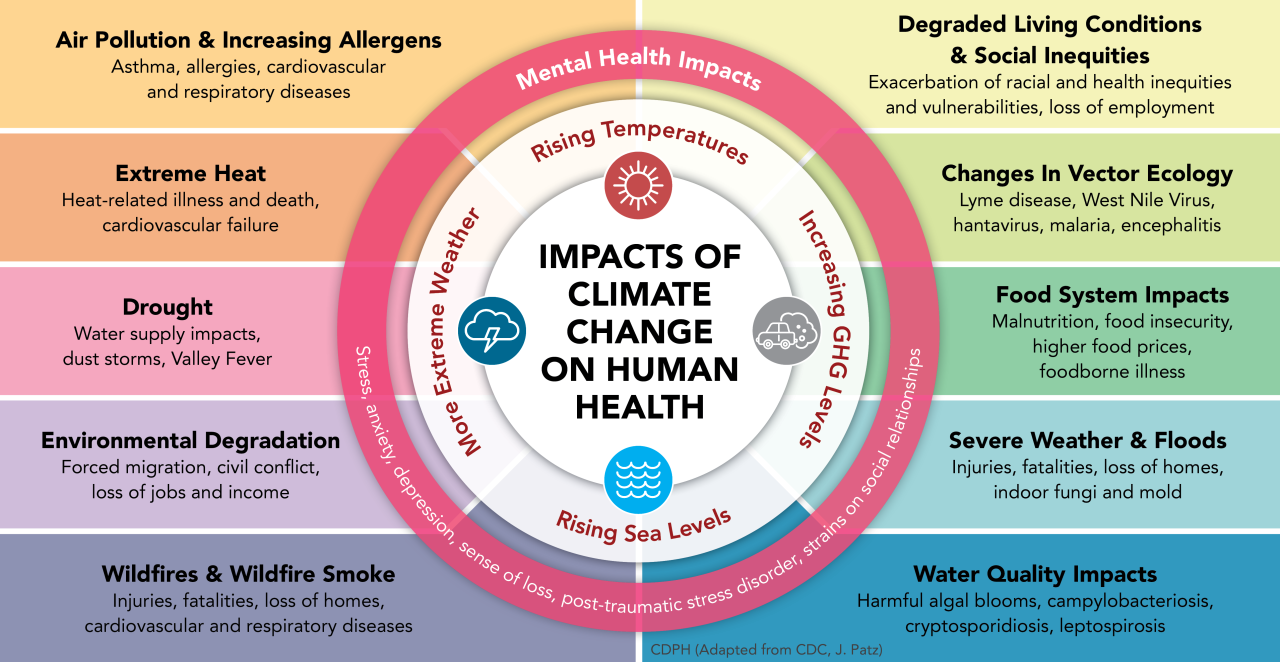

Health Insurance

- Climate-sensitive diseases (e.g., Lyme disease, malaria)

- Mental health effects from climate-related displacement

Agricultural Insurance

- Crop failures due to droughts or floods

- Shifting planting zones

Life Insurance

- Increased mortality linked to heatwaves and poor air quality

Table 1: Climate Risks by Insurance Type

| Insurance Type | Major Climate Risks |

|---|---|

| Property Insurance | Floods, wildfires, hurricanes |

| Health Insurance | Respiratory diseases, heatstroke |

| Agricultural | Drought, floods, pests |

| Life Insurance | Excess heat, extreme weather fatalities |

4. Sector-Specific Impacts

Homeowners Insurance

- Premiums in wildfire-prone areas have increased by 35% on average

- Some insurers have withdrawn coverage in high-risk zones

Auto Insurance

- Flood-damaged vehicles contribute to higher claims

- Increasing cost of claims due to supply chain disruptions

Business Insurance

- Increased risk of business interruption

- Higher premiums for companies in vulnerable sectors like agriculture and tourism

5. Geographic Premium Variations

Premiums now vary dramatically based on geography. According to Google Trends and recent search data, these regions are experiencing the most volatility:

- Florida, USA: Hurricane premiums have increased by 45%

- Australia: Wildfire-prone zones see 60% premium hikes

- Bangladesh: Flood insurance becoming unaffordable for many

Table 2: Average Premium Increases by Region (2020 vs. 2025)

| Region | Avg. Premium Increase |

|---|---|

| Southeast USA | +40% |

| Western Europe | +25% |

| Southeast Asia | +50% |

| Australia | +60% |

6. Technological Innovations in Climate Risk Assessment

To address these challenges, insurers are adopting advanced technologies:

Artificial Intelligence (AI)

- Predictive analytics for risk assessment

- Automated claims processing

Satellite Imaging & GIS

- Real-time monitoring of risk-prone zones

- Historical comparison for premium adjustments

Blockchain

- Transparent, immutable claim records

- Smart contracts for faster payouts

7. Regulatory Shifts and Their Impact

Governments and regulators are enacting new rules to ensure solvency and consumer protection:

- Mandatory climate risk disclosure by insurers

- Creation of climate resilience funds

- Incentives for “green” insurance products

These policies help stabilize the market but also add compliance costs for insurers.

8. Consumer Impact: Rising Costs and Reduced Coverage

Rising Premiums

- Average global insurance premium increase: 30% since 2020

Coverage Gaps

- Higher deductibles and exclusions in climate-affected zones

- More frequent non-renewals in high-risk areas

Bullet Points: How Consumers Are Coping

- Switching to parametric insurance

- Investing in property resilience (e.g., flood barriers)

- Bundling policies to reduce costs

9. Case Studies: Countries and Companies

United States: State Farm & Allstate

- Withdrawn from California home insurance market due to wildfire risk

United Kingdom: Lloyd’s of London

- Implemented climate stress tests for underwriters

India: ICICI Lombard

- Piloting crop insurance using drone surveillance and AI

10. Strategies for Insurers and Policyholders

For Insurers

- Diversify risk portfolios

- Invest in climate-resilient infrastructure

- Partner with tech firms for better modeling

For Policyholders

- Understand risk exposure

- Use climate data tools (like NOAA and FEMA maps)

- Choose insurers offering flexible, adaptive products

11. Future Outlook

Looking ahead:

- Greater use of technology in pricing and risk modeling

- Expansion of public-private insurance partnerships

- Growth of microinsurance and community-based insurance programs

Expect a more personalized, data-driven approach to premiums and a stronger emphasis on climate adaptation.

12. Conclusion

Climate change is fundamentally altering how insurance works. From rising premiums to new product innovations, the industry is undergoing a transformation that affects everyone. In 2025, both insurers and policyholders must remain proactive, adaptive, and informed. By leveraging technology, regulatory support, and transparent risk assessments, the insurance industry can not only weather the storm but also help build a more resilient future.