Introduction

As climate change drives a surge in extreme weather events worldwide, traditional insurance models are struggling to keep up. One innovative solution gaining traction is parametric insurance. Unlike conventional insurance that pays out based on assessed damage, parametric insurance provides payouts when pre-defined conditions are met—such as wind speeds, rainfall levels, or seismic activity. This guide explores the concept, benefits, limitations, and practical applications of parametric insurance in the context of natural disasters.

Table of Contents

- What Is Parametric Insurance?

- How Parametric Insurance Works

- Benefits of Parametric Insurance

- Limitations and Challenges

- Real-World Examples and Use Cases

- Comparison with Traditional Insurance

- Ideal Use Cases for Parametric Insurance

- How to Choose a Parametric Policy

- Future Trends in Parametric Insurance

- Conclusion

1. What Is Parametric Insurance?

Parametric insurance is a non-traditional insurance product that issues payouts based on the occurrence of a specific event, rather than assessing actual losses. The policy is triggered by a measurable parameter such as:

- Earthquake magnitude

- Rainfall level over a 24-hour period

- Wind speed of a cyclone

- River water height

This type of insurance is particularly useful for natural disasters where swift payouts are critical.

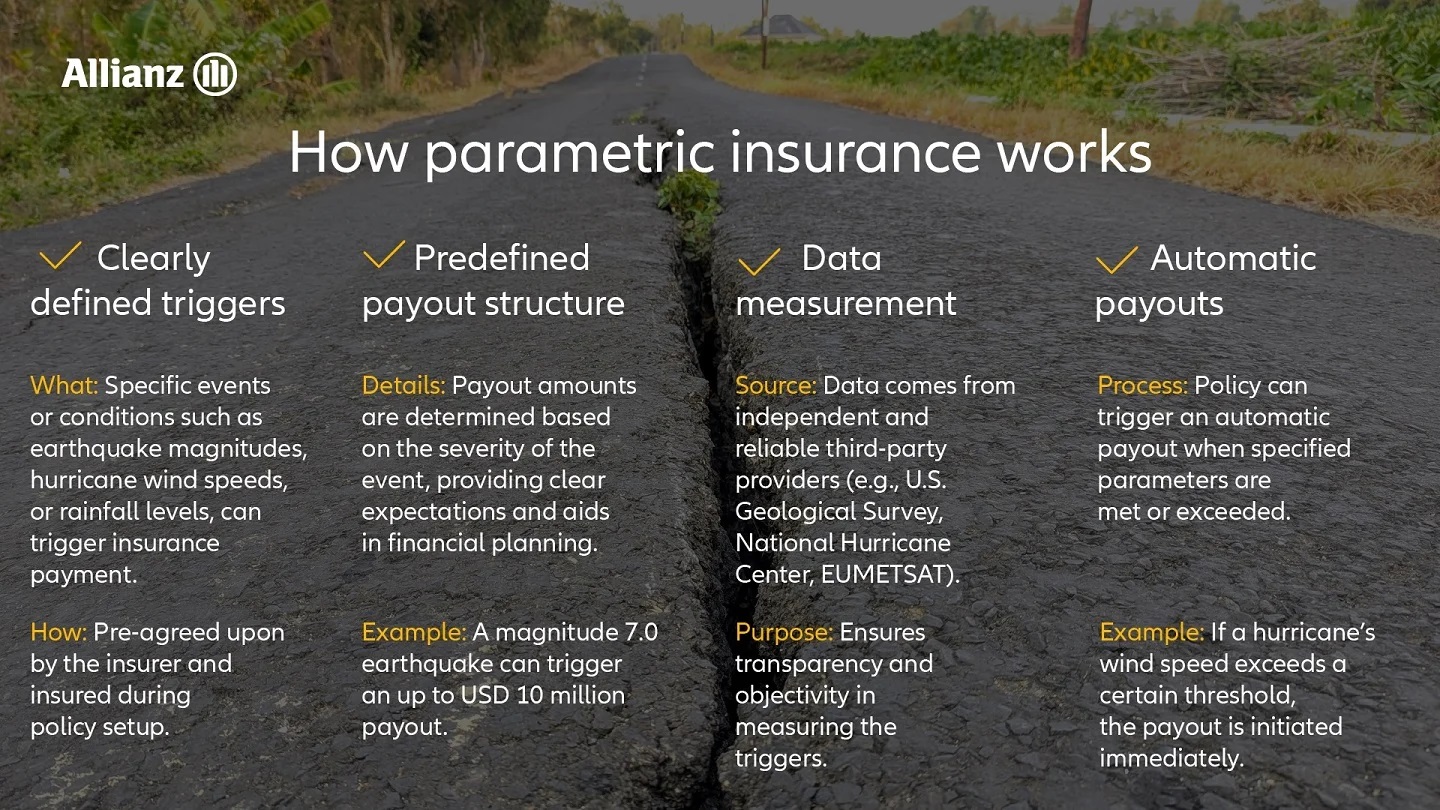

2. How Parametric Insurance Works

Key Components:

- Trigger Event: A specific, measurable condition (e.g., 7.0 magnitude earthquake)

- Payout Amount: Pre-determined sum paid when the trigger occurs

- Data Source: Trusted, independent source (e.g., meteorological agency)

Example:

If a policyholder has a parametric hurricane insurance policy with a trigger of 120 mph winds, and a storm with 125 mph winds hits the area, the payout is automatically issued without a loss assessment.

Table 1: Sample Parametric Triggers and Payouts

| Trigger Event | Parameter | Payout Amount |

|---|---|---|

| Earthquake | 7.5 magnitude | $50,000 |

| Rainfall | >200mm in 24 hrs | $30,000 |

| Hurricane | Wind >120 mph | $75,000 |

3. Benefits of Parametric Insurance

- Rapid Payouts: No need for damage assessment

- Transparency: Trigger conditions are clear and measurable

- Reduced Administrative Costs: No lengthy claims process

- Flexibility: Can cover events often excluded from traditional insurance

- Helps Bridge Protection Gaps: Especially in developing regions

4. Limitations and Challenges

- Basis Risk: Payout may not align with actual losses

- High Initial Setup Costs: Requires detailed data modeling

- Limited Coverage: Not suitable for all types of risks

- Regulatory Barriers: Some jurisdictions lack frameworks for parametric insurance

5. Real-World Examples and Use Cases

Caribbean Catastrophe Risk Insurance Facility (CCRIF)

- Provides parametric insurance to Caribbean nations against hurricanes and earthquakes

African Risk Capacity (ARC)

- Offers drought insurance based on rainfall indices

India’s Crop Insurance Programs

- Parametric insurance for rainfall and temperature-based crop failures

6. Comparison with Traditional Insurance

Table 2: Parametric vs Traditional Insurance

| Feature | Parametric Insurance | Traditional Insurance |

|---|---|---|

| Trigger | Specific data parameter | Actual damage assessment |

| Payout Speed | Fast (within days) | Slow (weeks or months) |

| Claim Assessment | Not required | Required |

| Administrative Cost | Low | High |

| Basis Risk | Yes | No |

7. Ideal Use Cases for Parametric Insurance

- Agriculture: Crop failure due to drought or flood

- Tourism & Hospitality: Losses from canceled bookings during hurricanes

- Energy Sector: Downtime from extreme weather events

- Government Programs: Emergency funds for disaster relief

8. How to Choose a Parametric Policy

Key Considerations:

- Understand the Trigger: Must be relevant and reliable

- Evaluate Basis Risk: Compare potential payout vs actual loss

- Check the Data Source: Ensure it’s independent and credible

- Review Payout Structure: Understand tiered vs flat payouts

- Assess Cost vs Benefit: Weigh premiums against potential losses

9. Future Trends in Parametric Insurance

- Integration with IoT and Smart Sensors

- Use of AI for Better Risk Modeling

- Blockchain for Transparent Claims

- Expansion into Urban Areas and Developed Markets

- Increased Role in Climate Resilience Strategies

10. Conclusion

Parametric insurance offers a fast, efficient, and transparent alternative to traditional insurance, particularly in regions vulnerable to natural disasters. While not without challenges—such as basis risk and regulatory hurdles—its ability to provide timely financial support makes it a valuable tool in the era of climate change. As technology and data analytics continue to evolve, parametric insurance is poised to become a vital part of global disaster risk management.